Statement of comprehensive income example - Nature Expense Method Net sales revenue Sales xx Sales - Studocu

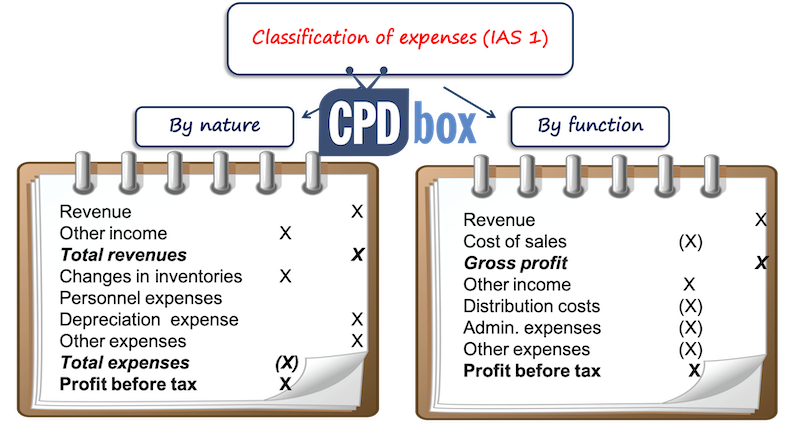

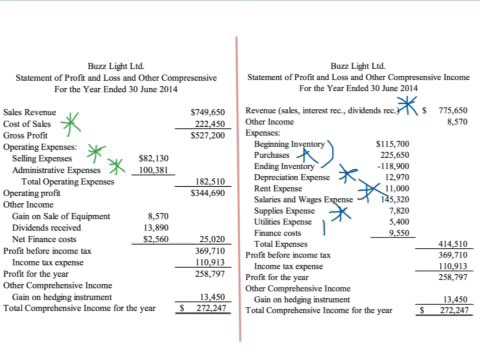

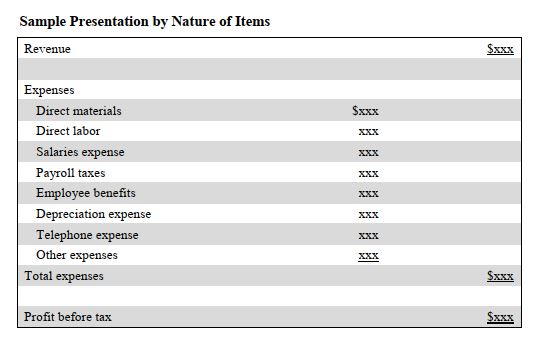

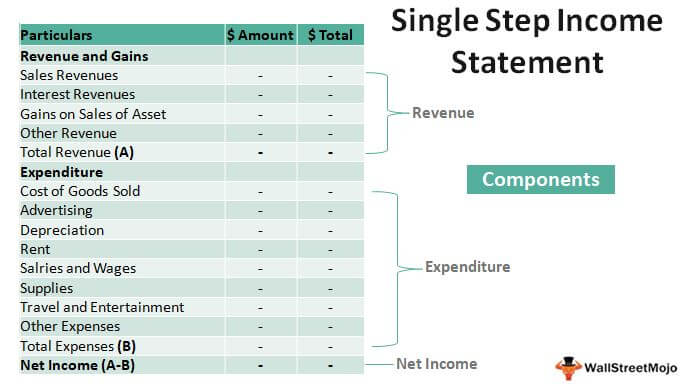

Parallel accounting according to the “Cost of Sales” and “Nature of Expense” accounting method (1) | Dynamics 365FO/AX Finance & Controlling

Potomac's accountant has just prepared an analysis of its expenses for the year, by nature and by functions. The company earned service revenue totaling $450,000 during the year. 1. Prepare Potomac'

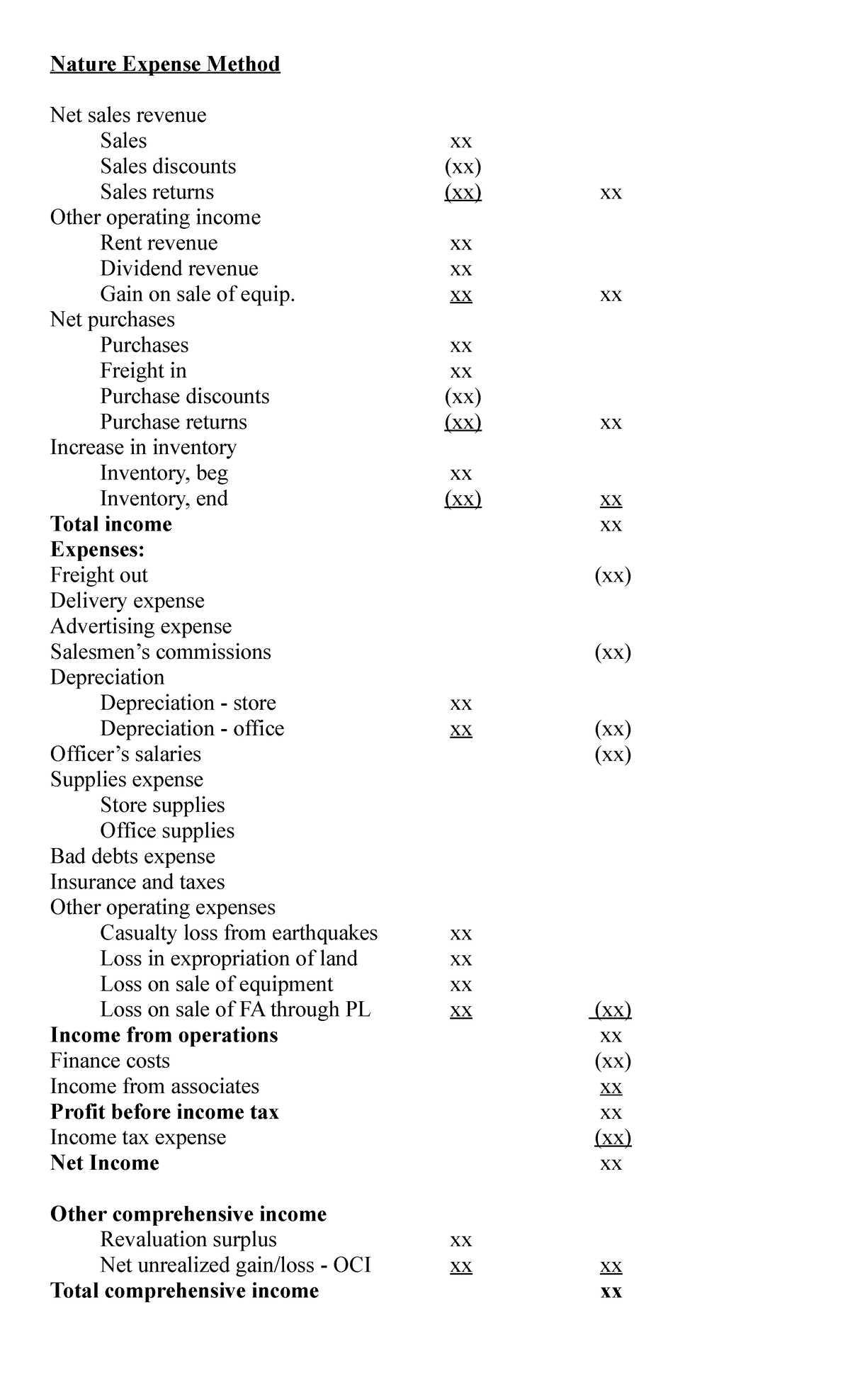

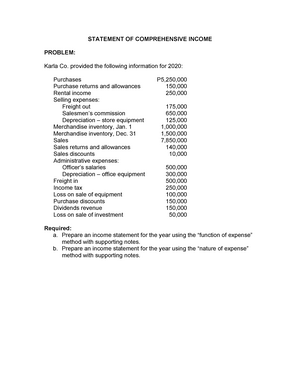

statement of comprehensive income problems with no answer - STATEMENT OF COMPREHENSIVE INCOME - Studocu

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)